Credit Scoring

Lean by design, robust in results

Our data-driven credit scoring solutions estimate default risk for companies and individuals based on financial data provided. They integrate seamlessly into existing workflows and provide high predictive accuracy.

Overview

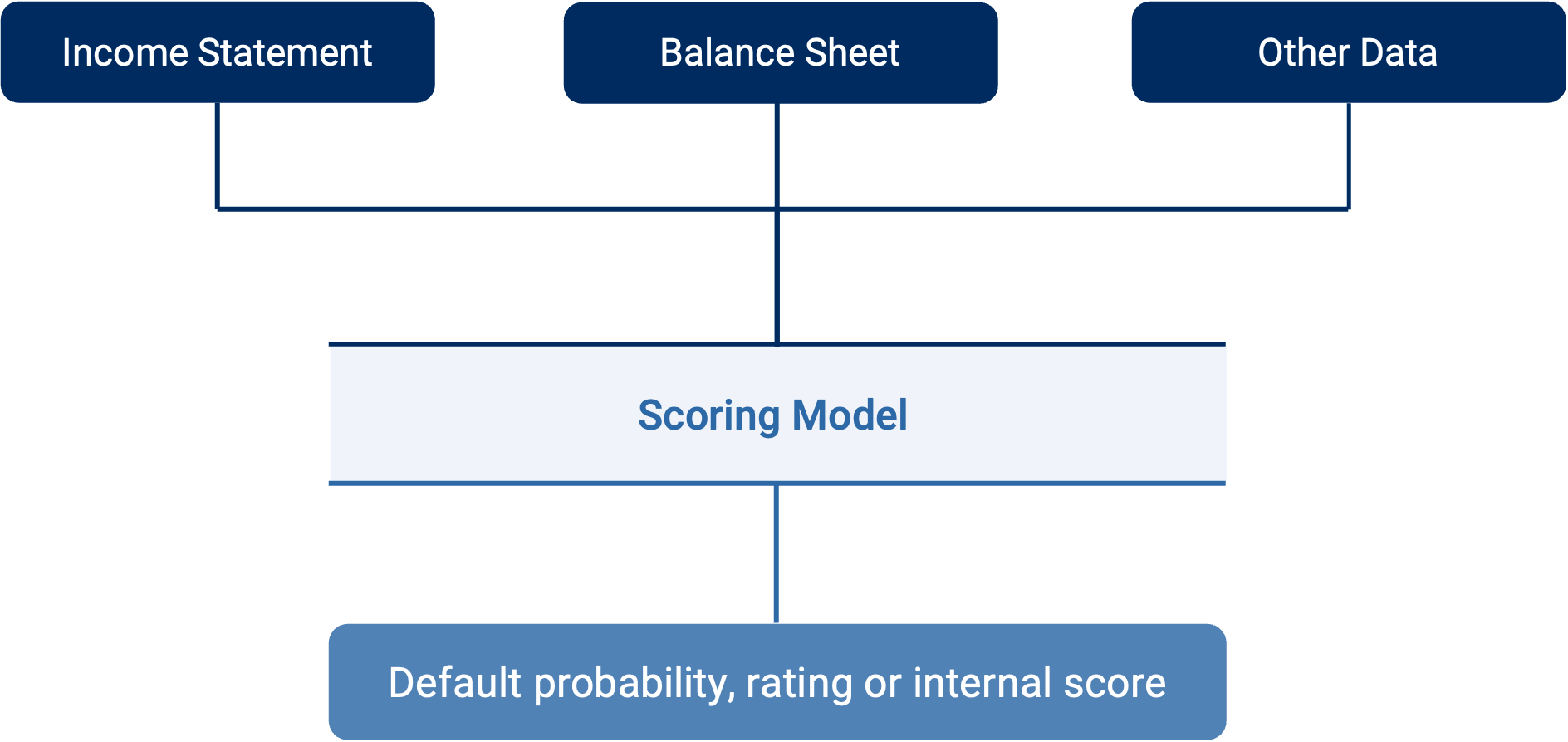

How it works

Users provide data about the counterparty to be scored, which our models use to generate credit risk estimates.

1. Collect Counterparty Data

This may include income statements, balance-sheet inputs, transactional records and more.

2. Input Data into Our Models

Data is submitted seamlessly through a range of interfaces to suit your workflow.

3. Obtain Results

Typically a default probability, a rating equivalent or an internal score assignment.

Access Options

Multiple interfaces, seamless integration

Explore the different ways you can access our scoring solutions.

Web App

Use our intuitive web app for convenient access through a simple, browser-based interface.

API

Access our scoring solutions programmatically through a secure and flexible API.

Excel Add-In

Integrate our Excel add-in to streamline workflows and perform in-sheet analytics with ease.

Python SDK

Leverage our Python SDK for seamless application integration and advanced data analytics.

Want to start scoring?

Request access to our credit scoring solutions and receive additional information.

FAQ

Answers made simple

How does your credit scoring work?

Why should I trust the scoring results?

Can I score counterparties across different sizes, sectors and geographies?

If I provide my own data, can you develop a custom model or use it for aggregation?

How does your pricing work?